What is a Cash App Card?

The Cash App Card, also known as the Cash Card, is a digital Visa card linked to your Cash App account. It allows you to make purchases, withdraw cash from ATMs, and receive direct deposits. In this detailed guide, we will explore the various aspects of the Cash App Card, including its features, benefits, and how to use it effectively.

How Does the Cash App Card Work?

The Cash App Card is a virtual card that can be used for online and in-store purchases. To activate and use the card, follow these steps:

- Download the Cash App on your smartphone.

- Sign up for an account and link a bank account or credit/debit card.

- Request a Cash App Card by entering your shipping address.

- Wait for the card to arrive in the mail.

- Activate the card by following the instructions provided.

- Start using the card for purchases and withdrawals.

Features of the Cash App Card

Here are some of the key features of the Cash App Card:

- Direct Deposits: You can receive your paycheck, tax refunds, and other direct deposits directly to your Cash App account, which can then be used to fund your Cash App Card.

- Debit Card: The Cash App Card acts as a debit card, allowing you to make purchases and withdraw cash from ATMs.

- Spending Limits: The Cash App Card has spending limits based on your account activity and creditworthiness.

- Free ATM Withdrawals: You can withdraw cash from any ATM with the Visa logo without incurring a fee.

- Customizable Card Design: You can choose from various designs for your Cash App Card.

Benefits of the Cash App Card

Using the Cash App Card offers several benefits:

- Convenience: The Cash App Card provides a convenient way to manage your finances and make purchases without carrying cash or using multiple cards.

- Security: The Cash App Card is a secure way to make purchases, as it is protected by Visa’s Zero Liability Policy.

- Free ATM Withdrawals: You can withdraw cash from any ATM with the Visa logo without incurring a fee.

- Customizable Spending Limits: You can set spending limits for your Cash App Card to help manage your budget.

How to Use the Cash App Card

Here’s how to use the Cash App Card for various transactions:

Online and In-Store Purchases

When making purchases online or in-store, simply enter your Cash App Card number, expiration date, and CVV code. You can also use the Cash App Card to pay with Apple Pay, Google Pay, or Samsung Pay on compatible devices.

ATM Withdrawals

To withdraw cash from an ATM, insert your Cash App Card and enter your PIN. You can withdraw up to $400 per day from any ATM with the Visa logo.

Direct Deposits

To receive direct deposits, go to the Cash App menu, select “Direct Deposit,” and enter your account and routing numbers. Once your employer or financial institution sets up the direct deposit, your funds will be available in your Cash App account.

Managing Your Cash App Card

It’s important to manage your Cash App Card effectively to avoid fees and maintain good financial health:

- Check Your Balance: Regularly check your Cash App account balance to ensure you have enough funds for your purchases.

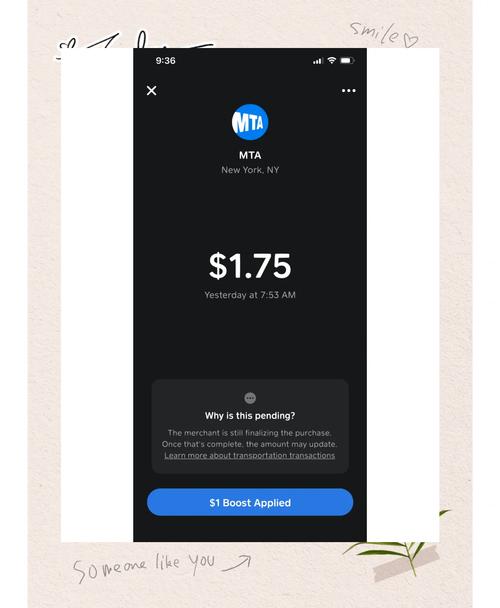

- Monitor Transactions: Keep an eye on your transactions to identify any unauthorized activity.

- Report Lost or Stolen Card: If your Cash App Card is lost or stolen, report it immediately to prevent fraud.

- Update Your Information: Keep your contact and address information up to date to ensure you receive important notifications and updates.

Table: Cash App Card Fees

Transaction Type

You missed |

|---|